Lack of access to basic financial services and even modest amounts of capital keep the world’s poorest people in a generational cycle of poverty.

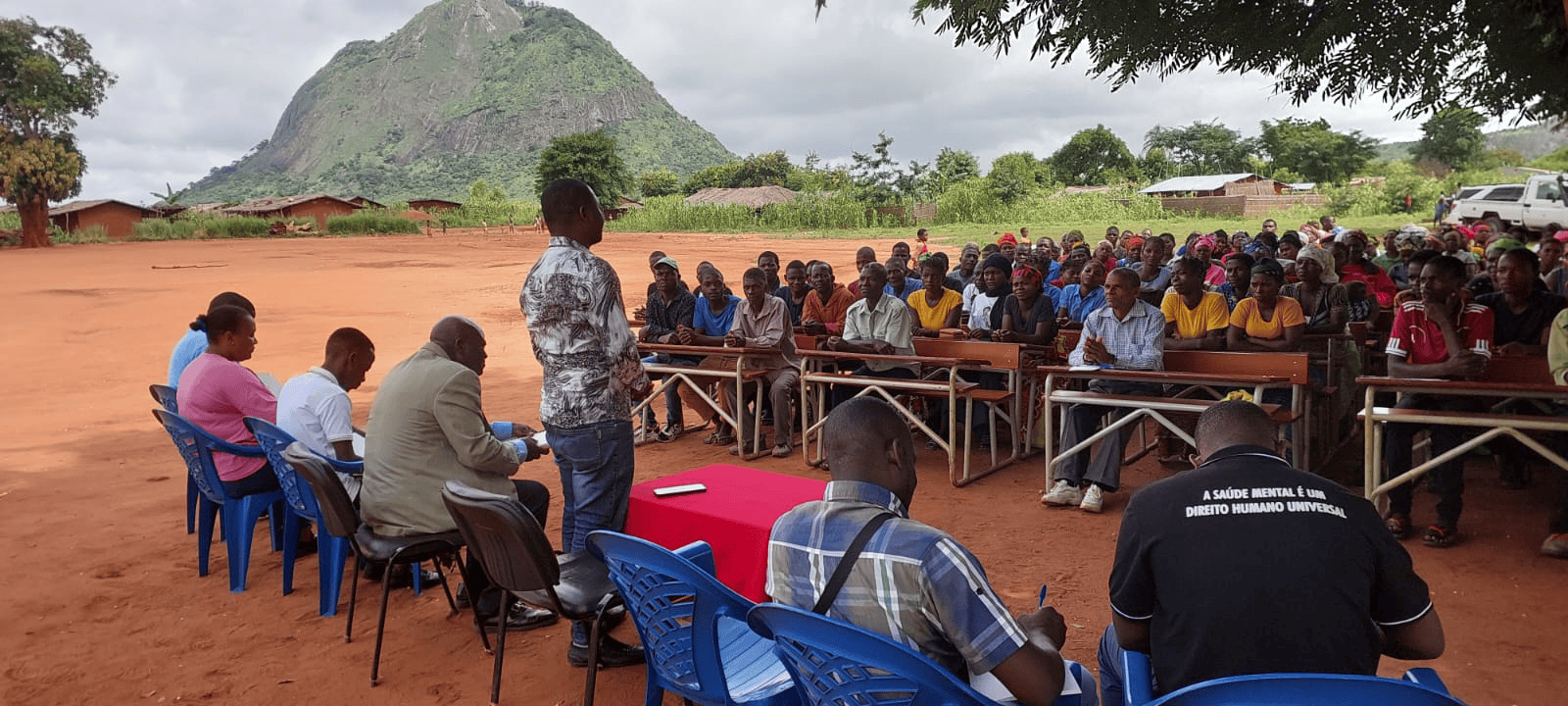

Community savings groups build financial literacy skills, strengthen social networks, promote the practice of savings, and provide access to micro-loans, supporting members to develop positive coping mechanisms in the face of economic shocks. By layering other services such as market-linked entrepreneurial training, positive parenting, HIV and gender-based violence prevention, and gender-transformative interventions, community savings groups serve as a platform for economic empowerment and social service provision.

Our interventions link community savings group members to formal financial services including micro-finance institutions, mobile banking, and banks.